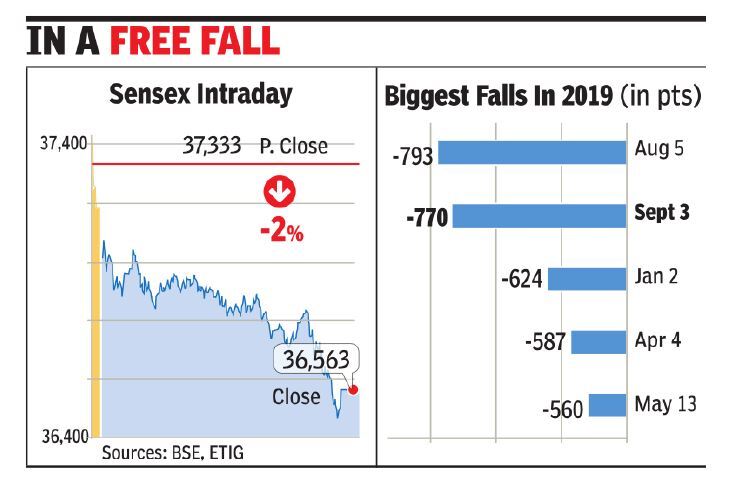

Poor economic data unnerves markets, sensex tanks 770 pts

A six-year-low GDP growth rate at 5% for Q1, which was announced on Friday after the markets had closed, weighed majorly on investor sentiment, brokers said. A weakening rupee, below-expectation industrial production data, a sharp decline in August auto sales and fall in GST collections all pulled the market down, they said.

"In the near term, weak domestic sentiments and uncertain global cues may continue to have negative impact on the Indian markets...we continue to remain cautious until there are meaningful signs of revival in the economy," said Ajit Mishra, VP-Research, Religare Broking. Another key concern for the market is the weakness of the rupee which could negatively impact sentiment. "On the global front, trade tension between US-China is likely to induce volatility across markets," Mishra said.

The day's selling on Dalal Street was led by foreign portfolio investors (FPIs) with a net selling figure of Rs 2,016 crore, while domestic funds, with a net buying figure of Rs 1,251 crore, cushioned the fall partially.

Auto and banking stocks were hammered the most. Market players were not enthused by the government's plan to merge 10 banks to form four larger banks, which was announced on Friday. Most analysts feel that after addressing technology and manpower integration issues post the mergers, it would take at least two years for gains from the economies of scale to kick in. Punjab National Bank closed 8.6% lower while Canara Bank closed 10.5% down. PNB will merge Oriental Bank of Commerce and United Bank with itself while Canara Bank will merge Syndicate Bank with it.

In the auto space, Maruti, the largest passenger vehicle manufacturer that reported a 36% annual drop in sales in August, closed 1.2% lower while M&M, another major automobile manufacturer, closed 2.5% lower.

Late in the evening, trade tensions took toll on the US markets with the Dow Jones index down more than 1% in early trade while crude prices in New York crashed over 3%.

A section of the market players, however, feel that there's excessive pessimism among investors and things are not as bad as they are being projected to be. "The amount of pessimistic statements that one reads these days is depressing no end. Such times do not last long. However, recoveries from such situations are neither V-shaped nor swift. The markets will consolidate at such levels for some time before one starts seeing a recovery," said Arun Kejriwal, director at KRIS, an investment advisory firm.

from Business News: Latest News on Business, Stock Markets, Financial News, India Business & World Business News https://ift.tt/2HKFTT9

Post a Comment