Top India FDI sources on tax haven list

TJN, an independent research based international network, estimates that $500 billion is dodged each year in tax by multinationals by use of a network of favourable tax countries. The index covers 64 countries, which are ranked based on a ‘corporate tax haven’ score. Some of the popular countries, through which FDI is routed into India, featured among the top 25 countries in this index.

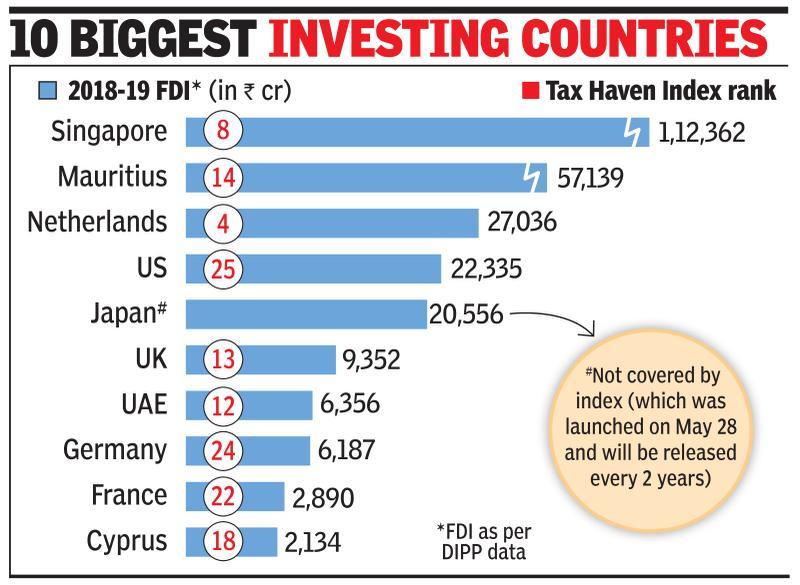

Other countries included in the index were Singapore (rank 8), UAE (12), Mauritius (14) and Cyprus (18). According to TJN, 52% of the world’s corporate tax avoidance risks can be attributed to the top 10 countries in the index (see graphic).

Based on the ‘corporate tax haven’ score, the index reflects how aggressively countries (tax havens) use low or nil corporate taxes, loopholes, secrecy, lax anti-abuse provisions and aggressive tax treaties (which provide benefits to stakeholders). Through these, they attract MNCs and enable them to escape or undermine tax regulations in other countries.

It has a ripple effect as other countries, to claw back foreign investments, resort to tax competitiveness. The index also factors in a global scale weight, which measures the presence of a country in cross-border transactions.

Tax consultants state that MNCs ensure that there is substance in their global tax-planning strategy in terms of carrying out operations across countries or investment transactions, so as to not fall foul of anti-avoidance provisions. However, as mentioned by TOI in its edition dated December 8, the CBDT[1] is taking a closer look at the ‘tax-planning’ mechanisms adopted by India Inc, which is on an outbound expansion spree.

For instance, aggressive tax-planning that results in parking of passive funds, such as royalty payments to related parties in favourable jurisdictions, or supply chain modalities that lack substance whereby only marketing operations are carried out in higher tax countries (such as India) are some issues in the harsh spotlight of the taxman.

The recently released draft report by a CBDT committee that discarded the common transfer pricing approach for attribution of profits of a foreign enterprise having a permanent establishment in India is also a step towards curbing profit shifting, said a government official. The committee has recommended a formula-based approach by applying the global operational profit margin to the revenue from India, with adjustment for various factors such as manpower and assets.

from Business News: Latest News on Business, Stock Markets, Financial News, India Business & World Business News http://bit.ly/2HKLV6I

Post a Comment