How brokers used NSE system to make fast buck

These servers are the heart of any exchange’s trading system. Brokers always try to have the fastest access to trading engines so that they can have the price information ahead of the competition, execute order before other brokers can do so and profit from the same. Hence, they try to place their own own servers closest to the exchange’s trading engines. Even a time difference of one thousandth of a second can lead to profit or loss worth crores of rupees.

At that time, the NSE had a software system that used to allow price information to reach brokers in the same sequence they had logged into its trading engine. The NSE also had a secondary server that was not known to many brokers and hence had lower load than the primary server. The server that had lower load also gave out trading information faster than the main server.

Three brokers — OPG Securities[3], GKN Securities[4] and Way2Wealth[5] Securities — knew about this system glitch in the NSE. So they had placed their servers in the NSE’s server room — or co-located their own with that of the exchange and always logged on to the secondary one ahead of others to get faster access to price information.

Some of the NSE officials were aware of this system glitch but rather than correcting the system, they facilitated the three brokers to continue to game the system to make illegal profit.

OPG Securities also hired top officials from an IT subsidiary of the NSE to have better understanding how the exchange’s server could be gamed. It also had some arrangement with a staff at NSE’s data center who could precisely tell the broker when the servers would start, which helped OPG Securities to connect to the server ahead of others. Some NSE staff also helped the broker to switch to the fastest servers to access trading data.

The co-location scam continued till 2014 when the NSE had to switch to a new system which allowed for distribution of trading data to all brokers at the same time, irrespective of when the broker had logged on to the server.

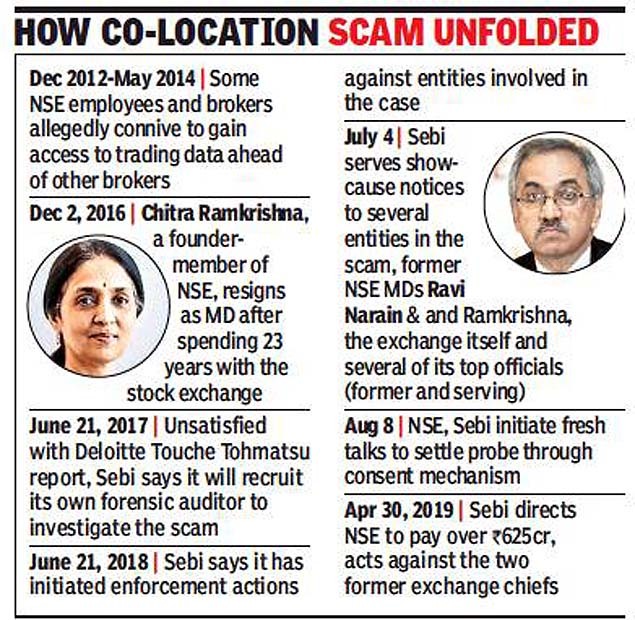

And then in August 2015, through a letter from a Singapore-based whistleblower, Sebi got a whiff of the matter and started investigating.

References

- ^ NSE (timesofindia.indiatimes.com)

- ^ Sebi fines NSE Rs 1,100 crore, bans two ex-MDs in brokers’ scam (timesofindia.indiatimes.com)

- ^ OPG Securities (timesofindia.indiatimes.com)

- ^ GKN Securities (timesofindia.indiatimes.com)

- ^ Way2Wealth (timesofindia.indiatimes.com)

from Times of India http://bit.ly/2GQABV7

Post a Comment