ELSS or NPS? Find out which suits you better

The problem? The low commissions paid to distributors are hardly any incentive to sell the NPS. “Till the NPS increases the commissions payable to distributors, buyers will continue to buy other products,” chuckles the marketing head of a private life insurance[3] company.

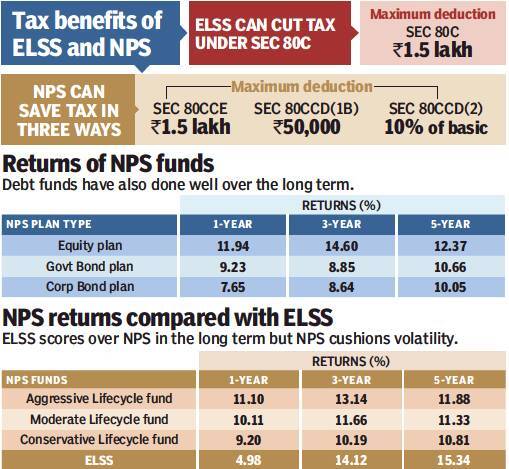

Data shows that investing in equity-oriented instruments[4] has the highest probability to make you rich in the long term. That would make mutual funds the obvious choice. But the NPS also has very low charges and offers significant tax benefits under three different sections of the Income Tax Act (see graphic).

We compare the NPS and the ELSS[5] on five major parameters. Read on to know which is the better option for you.

Returns: ELSS can outperform in the long run

ELSS funds are pure equity schemes[6] that maintain about 90-95% exposure to equities throughout the tenure. But NPS investors can’t allocate more than 75% of the corpus to equity funds, which further tapers off as the person grows older. This is why ELSS investors have gained more in the past 3-5 years.

The picture is different in the short-term. ELSS funds have risen by 4% in the past one year, while NPS equity funds have delivered double-digit growth. “The correction in small- and mid-cap stocks in ELSS portfolios has pulled down their returns, while large-cap oriented NPS funds have done well,” says Raj Khosla, managing director, MyMoneyMantra.

This could change in the longer term. The multi-cap orientation of ELSS funds has a greater potential to generate alpha over a longer period. NPS funds invest in a limited universe and may not be able to outperform the market in a big way.

Taxability: ELSS tax is 10%, pension fully taxable

Long-term capital gains from equity funds were tax-free till last year but gains over ₹1 lakh in a financial year are now taxed at 10%. Meanwhile, the tax on the NPS has been reduced. Earlier, only 40% of the corpus withdrawn at the time of retirement was tax free and the remaining 20% was taxed at normal rates. Now, the entire 60% is tax free.

However, the pension from the remaining 40% put into an annuity will be fully taxed as income. In case of ELSS, deft tax planning of capital gains can reduce the tax. But the tax on annuity from NPS is unavoidable. “The tax benefit under NPS amounts to a deferment of tax, rather than complete tax exemption,” points out Rohit Shah, founder & CEO, Getting You Rich.

Both ELSS and NPS are eligible for tax deduction under section 80C. But NPS investors get additional deduction of up to ₹50,000 under section 80CCD (1B). In the 30% tax bracket, this means additional tax[7] savings of ₹15,600.

Salaried individuals can claim more deduction if their employer puts up to 10% of their basic salary in the NPS under section 80CCD(2). There is no cap on this deduction. If your basic salary is ₹50,000 per month and you are in the 30% tax bracket, you can reduce your tax by almost ₹18,720 if your company contributes 10% of the basic in the NPS. “If your company offers NPS, don’t miss the opportunity to cut tax,” says Archit Gupta, CEO of tax filing portal Cleartax.

Flexibility: ELSS allows withdrawals, NPS allows switching

As mentioned earlier, ELSS funds invest only in equities, while NPS invests in a mix of equities, government securities, corporate bonds and alternative investments. Investors can choose their own asset mix if they are confident of making the right choice. Otherwise, they can opt for any of the three lifecycle funds—aggressive, moderate and conservative where the asset mix changes as the individual grows older. The gradual decline in equity exposure protects the corpus against volatility as retirement nears.

ELSS funds have a lock-in period of three years. Even if the fund is doing badly, you can’t touch the money before three years. But NPS allows investors to switch to another pension fund or change the asset allocation, twice in a year.

There’s another difference. An individual can spread his investments across as many ELSS funds as he wants. The NPS doesn’t allow such diversity. The investor has to go with just one pension fund for handling his entire corpus.

Liquidity: ELSS locked for three years; NPS till retirement

Once the lock-in period is over, ELSS investors can withdraw their funds and even stop investing altogether. The NPS has a much longer horizon. You can withdraw only at the time of retirement at 60.

Partial withdrawals are allowed only for specific reasons like child’s higher studies and marriage or treatment of critical illness. But you can do so only three times during the entire term of the investment and after you have completed three years in the NPS.

If the total corpus is less than or equal to ₹2 lakh, the subscriber can withdraw the entire amount. Subscribers can exit prematurely from the NPS if the account has completed 10 years. But in that case, the subscriber can withdraw only 20% of the amount lump sum and the remaining 80% will be put in an annuity to provide a monthly pension.

Some experts feel that the low liquidity in NPS is actually a plus point. “If you are prone to dipping into savings, the NPS is a better option because of the restrictions on withdrawals,” argues Shah.

Costs: NPS is much cheaper than ELSS

Mutual funds have a fairly simple cost structure. It is represented by a single number in the form of the total expense ratio (TER). The TER is deducted from the fund’s NAV on a daily basis. Regular plans of ELSS funds have a TER of around 2.4%, but direct plans bought without a distributor are cheaper by almost 75-100 basis points. Still, they cannot match the ultra low-cost structure of the NPS. At 0.01%, the fund management charge of the NPS is among the lowest for equity-linked instruments. However, this is not the only expense for the investor. NPS has different layers of charges, including one-time charges at the time of on-boarding and a flat fee payable for every transaction.

Despite the complex web of charges and deductions, the NPS still works out to be cheaper than even the direct plans of ELSS funds.

What investors should do

Given its high equity exposure, ELSS scores over the NPS for long-term wealth creation. “If one’s risk profile permits, ELSS is best suited for wealth creation in the long run,” says Ankur Maheshwari, CEO, Equirus Wealth Management.

Those who have not exhausted their section 80C limit of ₹1.5 lakh should first go for ELSS, and utilise the additional NPS window up to ₹50,000. Having said that, note that investment choices should not be guided merely by tax savings. Investors should also consider how an instrument fits into their overall financial plan and risk profile. NPS suits those who are not comfortable making investment decisions on their own. The auto choice in lifecycle funds provides a tailor-made solution for such investors.

Also, planners contend that both products can complement each other. “There is space for both products in a portfolio,” argues Suresh Sadagopan, founder, Ladder 7 Financial Advisories. NPS can be a strategic investment geared towards retirement, while ELSS can be used as a tactical avenue for other interim goals.

[1][2]

References

- ^ NPS (timesofindia.indiatimes.com)

- ^ tax benefits (timesofindia.indiatimes.com)

- ^ life insurance (timesofindia.indiatimes.com)

- ^ equity-oriented instruments (timesofindia.indiatimes.com)

- ^ ELSS (timesofindia.indiatimes.com)

- ^ equity schemes (timesofindia.indiatimes.com)

- ^ additional tax (timesofindia.indiatimes.com)

from Business News: Latest News on Business, Stock Markets, Financial News, India Business & World Business News http://bit.ly/2PAnuuY

Post a Comment